Accounting Voucher

What is Vouchers

Every business ought to have transactions where their ultimate profit and loss bring up. So, managing the transactions smarter gives a boost to the organizations. As many organizations moved toward , the voucher is the primary online document used to record the transactions.

Example:a purchase invoice, a sales receipt, a petty cash docket, a bank interest statement.

Types of Accounting Vouchers:

- Payment Voucher

- Receipt Voucher

- Contra Voucher

- Journal Voucher

- Sales Voucher

- Purchase Voucher

- Credit Note Voucher

- Debit Note Voucher

Double entry system

Example: giving the benefit and the other receiving the benefit.

- A transaction has two-fold aspects.

- One account needs to be debited and the other is to be credited.

- Every debit must have its corresponding and equal credit.

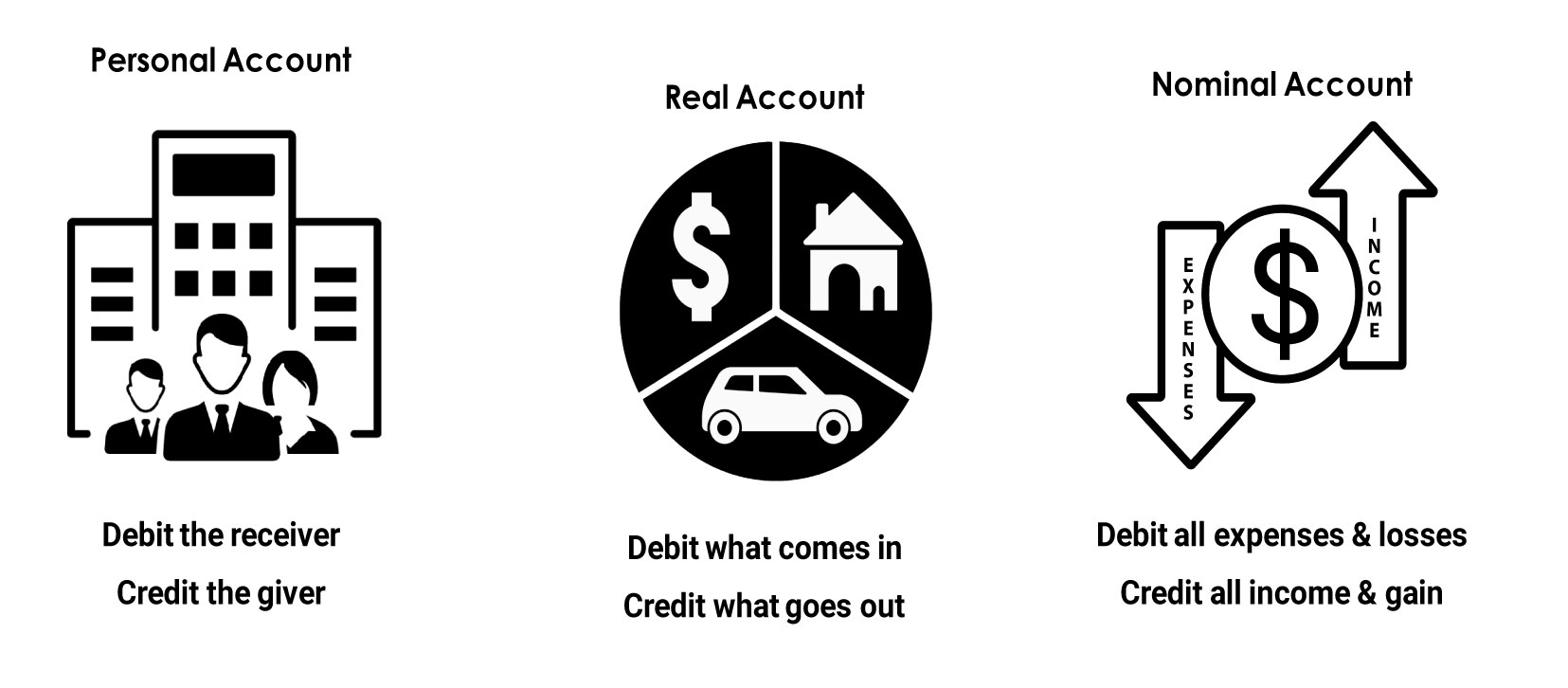

Golden Rules

Basic Accounting Equation

| Assets = Liabilities + Owners Equity(capital). |

Credit & Debit rules

Example You paid rent (₹1000).

Example for accounting equation

Example sum

| Particulars | ₹ Rupees |

|---|---|

| Started business with cash | ₹ 1,00,000 |

| Borrowed loan from bank | ₹ 25,000 |

| Deposited cash into bank | ₹ 60,000 |

| Bought goods and paid by cheque | ₹ 10,000 |

| Cash withdrawn for personal use | ₹ 5,000 |

| Cash withdrawn from bank for office use | ₹ 3,000 |

Solution

| S.no | Assets | Liabilities | Capital | ||

| Stock | Cash | Bank | |||

| 1 | + 1,00,000 | + 1,00,000 | |||

| 2 | – 60,000 | + 60,000 | |||

| 3 | + 25,000 | + 25,000 | |||

| 4 | + 10,000 | – 10,000 | |||

| 5 | – 5,000 | – 5,000 | |||

| 6 | + 3,000 | – 3,000 | |||

| + 10,000 | + 38,000 | + 72,000 | + 25,000 | + 95,000 | |

| ₹ 1,20,000 | ₹ 1,20,000 |

No comments:

Post a Comment